The 2025 FINRA Annual Conference, held in Washington, D.C. from May 13–15, brought together...

Discover how recent FINRA exam fee adjustments are reshaping the landscape for compliance professionals, licensing candidates, and organizations across the financial services sector.

Understanding the Latest FINRA Exam Fee Updates

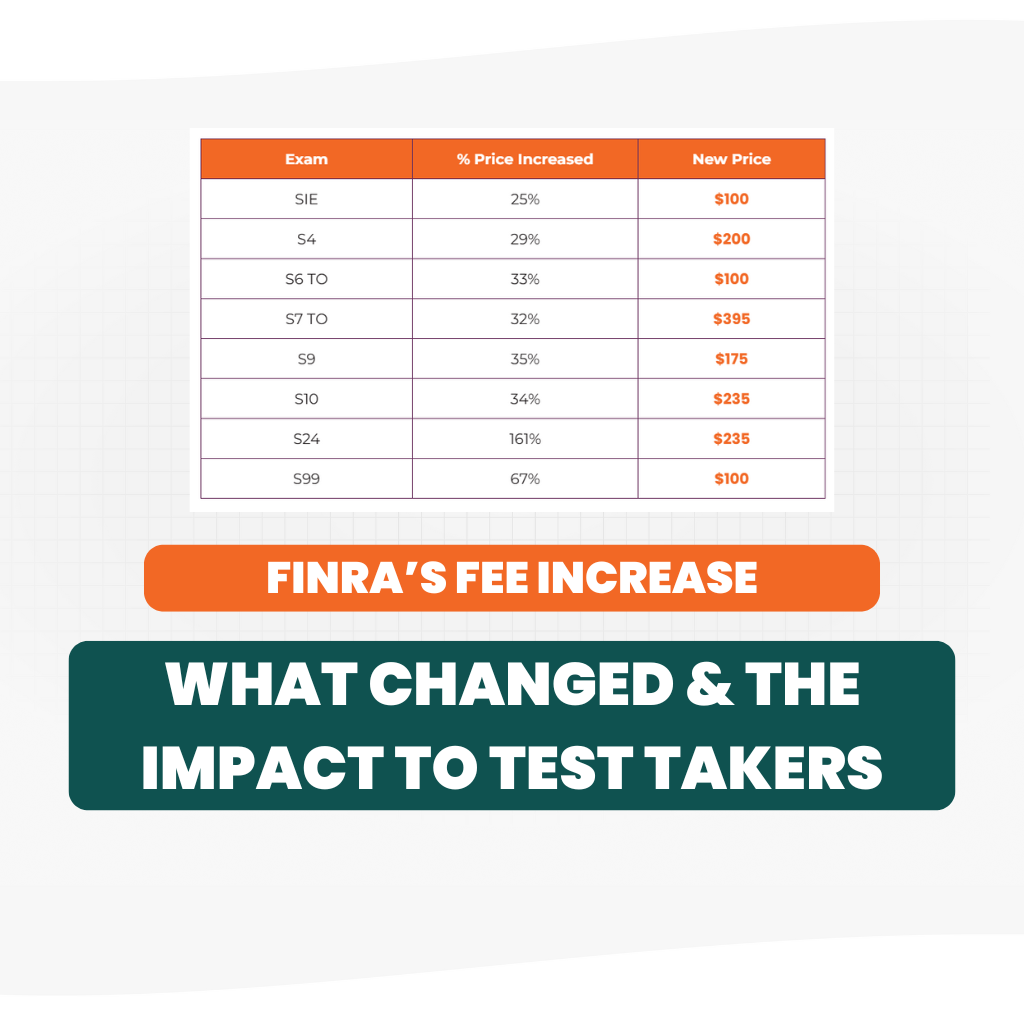

FINRA has implemented new pricing for several securities licensing exams. While some examination fees remain unchanged, others have increased, affecting both entry-level and advanced credentials. Below is a simplified table that outlines notable fee adjustments for commonly taken exams:

| Exam | % Price Increased | New Price |

|---|---|---|

| SIE | 25% | $100 |

| S4 | 29% | $200 |

| S6 TO | 33% | $100 |

| S7 TO | 32% | $395 |

| S9 | 35% | $175 |

| S10 | 34% | $235 |

| S24 | 161% | $235 |

| S99 | 67% | $100 |

These changes are effective immediately and will impact candidates registering for these exams moving forward. The adjustments reflect FINRA’s ongoing efforts to align exam pricing with administrative costs and industry demands.

Impacts on Financial Compliance Teams and Licensing Candidates

The updated FINRA exam pricing directly influences both individual candidates and financial services organizations. For candidates, increased fees mean higher out-of-pocket costs when pursuing new securities licenses. For financial firms, these changes will impact budgeting and exam preparation timelines, especially for those entering the industry or seeking to expand their qualifications.

For financial compliance and training teams, these fee changes may require reevaluating annual licensing budgets, onboarding processes, and support provided to candidates. Organizations may experience higher training and onboarding expenses, making efficient preparation and pass rates even more critical to control overall costs.

Strategies for Organizations to Navigate Fee Changes Efficiently

To adapt to these new pricing structures, organizations should proactively assess the impact of higher exam fees on their talent pipeline and compliance programs. Streamlining the candidate selection and onboarding process can help reduce unnecessary exam attempts and associated costs. Additionally, leveraging group discounts or volume-based pricing, where available, can help offset increased expenses for larger teams.

It is also essential for organizations to communicate these changes transparently to potential and current candidates, ensuring everyone is aware of the new requirements and cost expectations. Updating internal policies to reflect the latest FINRA pricing will maintain compliance and financial predictability.

Leveraging Technology and Training Solutions to Maintain Compliance

In light of increased exam fees, maximizing first-time pass rates becomes even more important for both individuals and organizations. Investing in adaptive, intuitive learning platforms—such as those provided by ExamFX—can help candidates prepare efficiently and effectively, reducing the likelihood of costly retakes.

Comprehensive training solutions, which include real-time regulatory updates, in-depth question banks, simulations, and live support, equip candidates to navigate exam content with confidence. Organizations can further benefit from group progress tracking, remediation recommendations, and scalable solutions that help manage onboarding costs and maintain ongoing compliance.

Preparing for the Future: Adapting to Ongoing Regulatory Shifts in the Financial Sector

FINRA’s recent fee adjustments are part of a broader trend toward evolving regulatory requirements in the financial services industry. Organizations and candidates should anticipate future changes and build flexibility into their compliance and training strategies.

Staying informed about regulatory updates and investing in up-to-date training solutions—like those from ExamFX—will help compliance teams and licensing candidates remain agile. By continuously optimizing their preparation and onboarding processes, organizations can ensure they are well-positioned to meet both current and future industry demands.

About the Author

Amy Sewak

Senior Editor

Amy has a robust background of over 12 years in customer service and 9 years as a content support representative in securities training at ExamFX. During this time, her primary role has been assisting customers in successfully navigating their securities licensing exams while addressing their queries.

She has 3.5 years of proficiency in content editing, specializing in developing and refining securities-related materials. This aptitude has proven instrumental in equipping customers with the necessary knowledge and skills to triumph in their examinations.

.jpg?width=50&name=Cindy%20(1).jpg)